The social insurance system in the US: Policies to protect workers and families – Brookings Institution

Guidance for the Brookings community and the public on our response to the coronavirus (COVID-19) »

Learn more from Brookings scholars about the global response to coronavirus (COVID-19) »

Download

Moriah Macklin

Senior Research Assistant – The Hamilton Project

This paper examines the U.S. social insurance system, which we define broadly to include both programs supported by dedicated taxes and other federal programs that provide income support, assistance in meeting basic needs, or services to improve economic opportunity. The paper considers the social insurance system as a whole as well as its component parts, providing an overview of major federal programs in the areas of education and workforce development, health, income support, nutrition, and housing. The paper covers how the social insurance system is organized, how eligibility is determined and who benefits, how the benefits and services are delivered, and how the system affects poverty and inequality. We focus primarily on the system as it operated prior to the onset of the COVID-19 pandemic, but also look at how various programs respond to economic downturns. Coming at a time when policymakers will start shifting their focus from using the social insurance system to provide relief from the pandemic and recession to considering what changes should be made in the system on an ongoing basis, the paper also reprises an array of proposals to strengthen the system in various ways that The Hamilton Project has commissioned in recent years.

The social insurance system in the United States, implemented by federal, state, and local government agencies, provides protection against what President Franklin Delano Roosevelt called the vicissitudes of life: disability, the loss of earnings in old age, being laid off, and other setbacks. The social insurance system also provides support to help people meet their basic needs and gain the skills and services they need to enter and succeed in the workforce. It encompasses a wide range of government programs, from the Social Security system, to Unemployment Insurance (UI), to early childhood education. Nearly everyone in the United States directly benefits from the social insurance system at some point in their lives. Moreover, everyone indirectly benefits from it—either from knowing the system would be there for them during some unexpected hardship or simply because it helps to support the overall economy.

In framing this paper, we explore how the social insurance system is organized, how eligibility is determined and who benefits, how the benefits and services are delivered, and how the system reduces poverty and inequality. We define the system broadly to include both benefits and services programs, and both programs without income limits and programs targeted by income or other factors. The paper examines the system as a whole and its component parts, providing an overview of the major government social insurance programs in the categories of (1) education and workforce development; (2) health; (3) income support; (4) nutrition; and (5) shelter. We also consider how programs operate during economic downturns as well as in more normal economic times; we focus on the structure of the social insurance system as it was prior to the onset of the COVID-19 pandemic.

Through this exercise, avenues for improvement and reform emerge. The paper reviews an array of Hamilton Project policy proposals to improve the social insurance system, including how various supports could be better targeted, how programs could be made more efficient, and how the system could better reach the most vulnerable families and individuals during economic downturns and during more normal times. Recent Hamilton reports have advanced proposals in such areas as UI, Social Security, health insurance coverage, paid leave, the Supplemental Nutrition Assistance Program (SNAP), the Earned Income Tax Credit, housing, childcare, education and workforce development, and Temporary Assistance to Needy Families (TANF).

This paper comes at an important juncture, as policymakers shift in the period ahead from using the social insurance system to provide widespread relief during the COVID-19 pandemic and related recession to designing and instituting (as well as reauthorizing) reforms that will strengthen the social insurance system so that it can make the economy more resilient and better provide protection from the vicissitudes of life.

This chapter offers our working definition of the social insurance system and provides an overview of how it works. We describe how the federal, state and local governments provide benefits through the social insurance system and who, on the whole, receives those benefits. We also describe evidence on how social insurance programs reduce poverty and income inequality in the United States. In a box, we offer brief highlights of the major programs that make up that system.

There is no uniformly agreed-on definition of social insurance, but two definitions—one narrower and one broader—are often used. Under the narrower definition, social insurance consists of government programs in which workers (and/or their employers) pay dedicated taxes to the programs during the years that the workers are employed. The workers then qualify for benefits from the programs when they reach retirement age, are determined to have a disability, are laid off, or experience another qualifying event. The main social insurance programs under this definition are the Social Security programs, Medicare, and UI.

The broader definition of social insurance includes both the programs supported by dedicated taxes and other programs (including tax credits) that provide income support; help people secure or afford necessities such as food, housing, and health-care coverage; or provide services or benefits to improve economic opportunity such as education and job training, as well as child care. The broader definition similarly includes both what are often referred to as universal programs and what are often referred to as targeted programs, with the difference being whether a program is open to otherwise-eligible families or individuals regardless of their income level or whether the program has an income restriction, usually an upper income limit. (No programs are entirely universal in the sense that people of all ages, incomes, immigration statuses, and the like are eligible.)

The broader definition, which we use, encompasses programs that are entitlements, programs funded through the annual appropriations process, and programs that are funded outside the appropriations process but that are not entitlements. We do not, however, include as social insurance various benefits that employers (rather than the government) may provide, such as employer-based health-care coverage or retirement plans. We focus on federal programs, many of which are administered in whole or in part by states (or in some cases, localities) and some of which are jointly funded by the federal and state governments with both levels of government playing a role in setting the programs’ eligibility criteria and/or the benefit levels. As a result, benefit coverage for a number of the programs (and gaps in coverage) varies across the country.

Some social insurance programs, such as Social Security and UI, were born out of the Great Depression. Others were created from the mid-1960s to the mid-1970s, including Medicare, Medicaid, the Supplemental Security Income program, the Supplemental Nutrition Assistance Program (SNAP; formerly known as the food stamp program), and the Earned Income Tax Credit (EITC), as well as Head Start and the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC). Still others are more recent; for example, the Children’s Health Insurance Program (CHIP) and the Child Tax Credit (CTC) were established in 1997, while subsidies to make private health insurance more affordable were established under the Patient Protection and Affordable Care Act (Affordable Care Act), which was enacted in 2010 and largely took effect in 2014.

A number of these programs play the role of so-called automatic stabilizers: they expand without Congressional intervention to serve more people in recessions when need increases and then contract when the economy rebounds. In so doing, they help to smooth out changes in people’s spending power over business cycles and thereby help moderate the depth of recessions and hasten economic recovery (Lee and Sheiner 2019). This is particularly true of UI, but it also applies to programs such as SNAP and Medicaid.

For tractability, we organize the social insurance system into five broad categories. For highlights, please see Box 1; for a more in-depth review of the programs and Hamilton Project proposals for reform, see Chapter 2.

The range of social insurance programs discussed in this paper is not meant to be exhaustive. For example, there are many shelter and workforce development programs that are relatively small in dollar terms, including several block grants and development funds, that we do not discuss here. Other social insurance programs that are discussed, including TANF and SNAP, include components of workforce and education training programs that we don’t cover in detail. Another example of a smaller program not discussed here is the Low Income Household Water Assistance Program (LIHWAP), which provides water and wastewater assistance to some low-income households. To be sure, the smaller programs are part of the social insurance system and can be important for beneficiaries, but for manageability this report focuses on the larger programs.

How government delivers social insurance depends first on what level of government provides the funding for a program, delivers the benefits, and sets the rules for who qualifies and how much they receive. Another key dimension is whether a program is delivered on an entitlement basis, under which all eligible individuals or households who apply must receive the benefit, or whether the program provides benefits only to as many people as its appropriated funding for the year allows, with other people who apply being put on waiting lists or turned away despite meeting the eligibility criteria.

The determination of whether a program operates as an entitlement also has implications for a third key issue—the degree to which programs expand automatically in recessions. While policymakers have regularly stepped in to expand the social insurance system in certain ways during economic downturns, certain programs expand and contract automatically—to serve more or fewer people—as need increases or subsides. By expanding during recessions to provide relief to people whose incomes have declined, the automatic stabilizer feature of these programs helps to support households’ purchasing power when the economy falters.

In that sense, those features of some key programs resemble the popular understanding of insurance. For example, employed people benefit from the existence of unemployment insurance and people who currently are financially secure benefit from the existence of SNAP. In both cases, those people know that those programs exist for them if times turn bad, helping them temporarily to maintain their spending during those times. In some ways that is like a homeowner benefiting from knowing their home is insured against fire or other disaster.

The Roles of Different Levels of Government

The social insurance system is funded by taxpayers and administered by the government. Some major programs, such as Social Security and Medicare, are both funded and administered by the federal government. That also is true of tax credits that provide income support and are part of the social insurance system, such as the EITC and the CTC. A larger number of programs, however, are fully or partially funded by the federal government but are administered by states (or, in the case of low-income rental assistance programs, administered primarily by local housing agencies and in some cases by state agencies). In some of these joint federal-state programs, the federal government fully funds the benefits and partially funds state and local administrative costs. SNAP and low-income housing programs fit that pattern. In other cases, such as Medicaid, states must provide a share of both the benefit and the administrative-cost funding.

There also are variations in what level of government sets the eligibility rules. The federal government sets the national standards in programs that are both federally funded and federally administered, like Social Security and Medicare. In programs like SNAP the federal government prescribes the benefit amounts and most of the eligibility rules, but states have options to modify some of the eligibility rules, and most states use these options. In Medicaid the federal government has established both a set of mandatory coverage categories—categories of people whom state Medicaid programs must cover—and a set of optional coverage categories, with states having the option of whether or not to cover the people in them, with the result that considerable variability exists across states in who is eligible for Medicaid. Similarly, the federal government prescribes a set of mandatory health services that state Medicaid programs must cover and a set of optional health services that states can elect to cover.

Differences between Entitlements and Discretionary Programs

A number of the programs are open-ended entitlement programs, meaning that all eligible individuals or households that apply must be served. Social Security, Medicare, Medicaid, SSI, SNAP, UI, and various tax credits are examples. Tax credits in the social insurance system include the EITC, CTC, CDCTC, and premium tax credits to subsidize health insurance in the Affordable Care Act’s insurance marketplaces.

Programs that are not entitlements, by contrast, are limited to the discretionary, annual funding they receive each year through the federal appropriations process and/or through a separate capped federal funding stream. The Child Care and Development Block Grant (CCDBG) and low-income housing programs are examples of this type of program. Other examples include federal child-care assistance, which as a result of limited funding relative to need, reached the families of only one in every six children who qualified for it prior to the pandemic, while federal rental assistance reached only one in every five eligible low-income households.

Responding to Recessions

Programs that are open-ended entitlements can respond automatically in recessions: as people lose jobs and their incomes fall, more people become eligible and enroll in various of these programs. These programs expand automatically to serve more people, which also helps bolster a flagging economy. Conversely, these programs offer less fiscal support when the economy is doing well and fewer people need—and qualify for—this assistance, which can help to stabilize an economy at risk of overheating. Programs that are funded through discretionary federal spending or through a separate capped-funding stream (such as the TANF block grant) lack this feature.

Although entitlement programs like UI, SNAP, and Medicaid see their enrollments grow in recessions without action by Congress because more people meet their eligibility criteria, it takes congressional action during downturns to broaden the eligibility criteria in these programs, boost the benefit levels, or (in programs like Medicaid where the federal government and the states split the costs) to increase the federal share of costs. Indeed, roughly half the economic stabilization produced by fiscal policy since 1980 has been the result of policies undertaken by policymakers, rather than a result of automatic stabilizers already built into the programs (Sheiner and Ng 2019). For example, during recent recessions federal policymakers have acted to expand UI beyond the expansion that occurs automatically; in the current recession, policymakers have broadened UI eligibility and increased both benefit levels and benefit duration. Federal policymakers have also acted in recent recessions to raise the federal share of Medicaid costs and to increase SNAP benefit levels, somewhat broaden SNAP eligibility, and provide added funding for state administrative costs. These types of changes in programs like UI, Medicaid, and SNAP typically are temporary; they are put in place for a specified period of time.

Federal policymakers can also elect to increase funding for various non-entitlement programs in recessions. In 2020 and 2021, for example, policymakers provided additional funding for low-income housing programs, child care, and the WIC program, among others. In addition, policymakers can establish temporary new programs or program components, such as programs put into effect in 2020 to help mortgage holders and renters remain in their homes, with a focus on those who otherwise lacked the financial resources to pay their monthly housing expenses.

Such changes provide both further relief to affected households during an economic slump and further stimulus to the economy, because the benefits provided by these temporary program expansions to low-income households, and to those who recently lost their jobs, tend to be spent quickly rather than saved.

Program Size and Growth

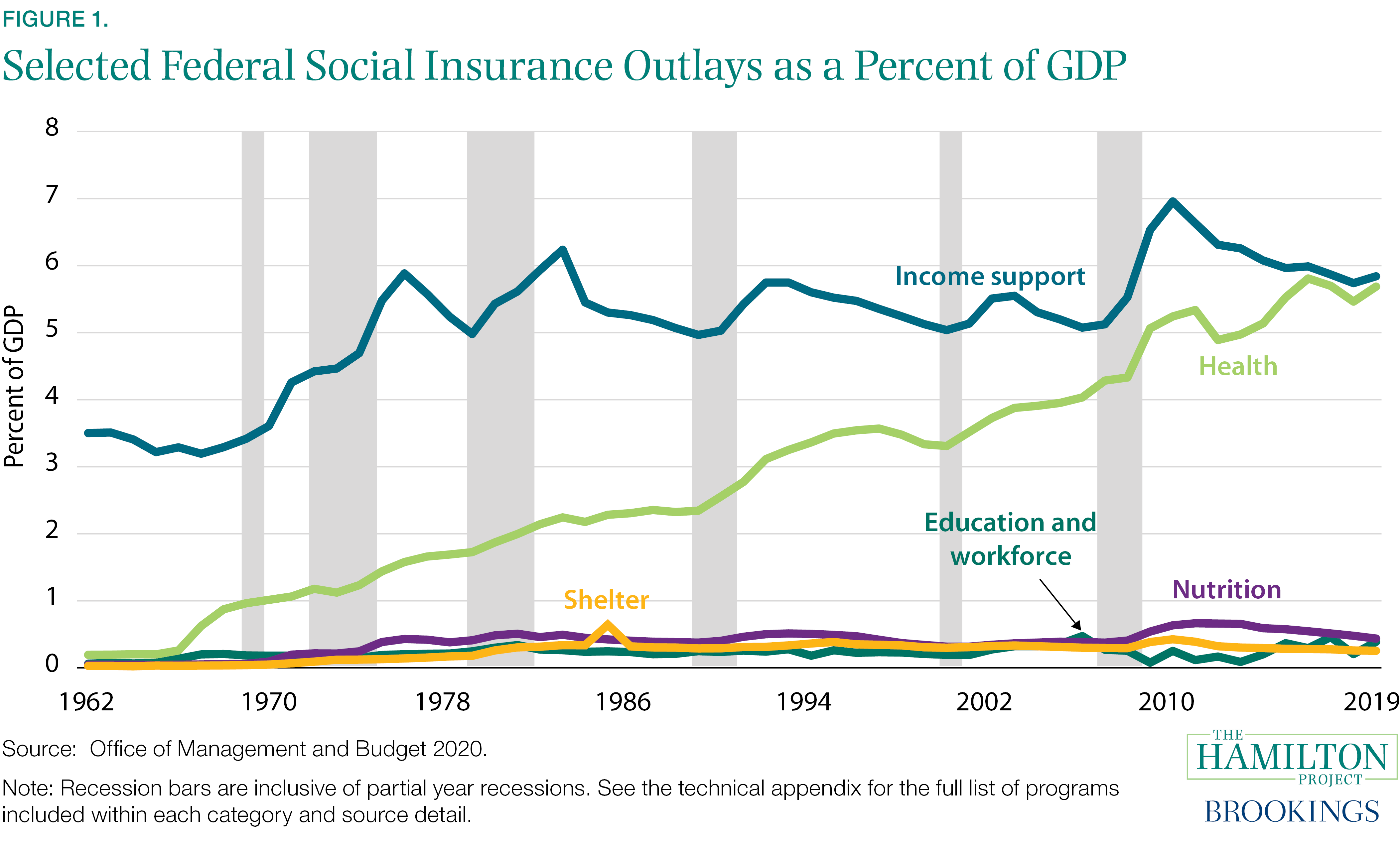

In fiscal year 2019 the federal government spent $2.7 trillion (about 13 percent of the nation’s gross domestic product, or GDP) on social insurance programs. As shown in figure 1, the largest programs are income support (which includes Social Security) and health coverage programs. In 2019 Social Security outlays equaled $1.0 trillion, or 23 percent of the federal budget (4.9 percent of GDP). Expenditures for health insurance programs outside the VA and DoD —i.e., for Medicare, Medicaid, CHIP, and subsidies for coverage in the Affordable Care Act’s marketplaces—amounted to $1.1 trillion, or 26 percent of the federal budget (5.3 percent of GDP), with Medicare responsible for nearly three-fifths of this amount. Expenditures for other social insurance programs that deliver assistance to people in need (i.e., social insurance programs other than Social Security and health insurance programs) totaled $518 billion in 2019, or about 12 percent of the federal budget.1

Changes over time in the inflation-adjusted costs of social insurance programs—other than increases during recessions for certain programs followed by decreases during economic recoveries—stem from three main factors: demographic changes (i.e., the aging of the population), increases in health-care costs, and decisions made by policymakers to expand or cut programs. The aging of the population and health-care costs are the factors driving the projected cost of Social Security and Medicare. Indeed, in 2019 the Center on Budget and Policy Priorities (CBPP) projected, based on Congressional Budget Office (CBO) forecasts, that in the absence of action by policymakers to expand or shrink programs, virtually all of the increase in total federal program spending over the coming decade (i.e., spending exclusive of interest payments) would be due to the increased costs for Medicare and Social Security (CBO 2019; Kogan and Bryant 2019).2 The CBPP analysis projected that costs for federal spending outside Medicare, Social Security, and interest payments would actually decline slightly as a share of GDP over the decade ahead. On the other hand, spending for mandatory programs targeted on lower-income households—that is, spending for targeted programs that are entitlements or otherwise have their funding levels determined outside the appropriations process—would remain largely unchanged as a share of GDP over the coming decade (Kogan and Huang 2019).

The COVID-19 pandemic, the accompanying recession, and policymakers’ responses to these developments have magnified the uncertainty about long-term cost estimates for various programs. Changes to the social insurance system by policymakers, both enacted in the past year and proposed, could substantially alter that outlook.

Social insurance can be delivered

In addition, some programs provide benefits (such as those just noted), while other programs provide services such as education, job training, or assistance for persons with disabilities or older adults.

In short, this is a varied and multifaceted terrain. Given the range of human needs and the different types of programs and delivery mechanisms, a mix of approaches that includes benefits in cash, vouchers, and the direct provision of goods and services may make sense. There is considerable debate, however, over how best to improve the current mix of program designs and what reforms would significantly strengthen the system.

Cash Benefits

Several social insurance programs provide cash benefits without constraints on how the money can be spent. Social Security, SSI, and the TANF block grant fall in this category. So do the checks that the Internal Revenue Service (IRS) sends to tax filers who qualify for refundable tax credits like the EITC and CTC. Some analysts believe cash provides the greatest value to recipients, but the evolution of social programs over the last half century suggests that the public and policymakers can be reluctant to provide benefits in cash and have often been more amenable to the provision of vouchers and in-kind benefits (Liscow and Pershing 2020; Greenstein 1991).

Vouchers

Vouchers are used in and work through commercial marketplaces. SNAP provides vouchers, via a debit card, that households use to purchase food in retail food stores. Beneficiaries choose which foods (to be prepared at home) to buy. When SNAP began, it represented a marked departure from the food commodity programs that preceded it, under which beneficiaries had to travel to food depository points where they were given boxes of specific foods, which often reflected what foods were in surplus rather than foods to provide a balanced nutritional diet. Similarly, households receiving rental vouchers (primarily through the federal government’s Housing Choice Voucher program) can use the vouchers to offset a portion of the rent for a unit they choose, as long as the landlord accepts vouchers. Some programs that provide or subsidize health coverage also use a voucher-like approach. People who purchase health insurance in the Affordable Care Act’s insurance marketplaces—with the help of a premium tax credit—are essentially using a voucher to purchase coverage of their choice that meets Affordable Care Act standards.

The advantages of vouchers, relative to providing specific goods, include providing consumers with choice regarding such things as which foods to buy, apartments to rent, or health insurance plan to purchase. For vouchers to work successfully, there must be a competitive well-functioning marketplace that meets basic standards the program establishes. In the case of SNAP, nearly all significant grocery stores and supermarkets participate. Acceptance of rental vouchers is fairly widespread but not universal, and in some locations tends to be at less-than-desirable levels. For the Affordable Care Act’s premium tax credits to work effectively, it is necessary to ensure a functioning marketplace with an adequate number of competing insurance plans in each area, something various other ACA provisions are designed to provide.

Program Areas with Combination Approaches

Child care is an example of a program area with multiple programs and approaches. The CDCTC subsidizes a portion of child-care costs that families incur, via a once-a-year benefit delivered through the tax system. The CCDF, by contrast, provides funds to states; state governments can use them in a number of ways, including subsidizing the cost of child care for low-income working families, improving the quality of child care, or establishing child-care resource and referral (CCR&R) agencies that provide important connections between parents and child-care providers in local communities. In contrast to the benefit provided by the CDCTC, the government can use the CCDF to set quality standards for the child care it supports.

Benefit Frequency

Different social insurance programs deliver benefits at varying frequencies. Most programs provide benefits or services on a monthly basis, such as Social Security, SNAP, Medicaid, the Affordable Care Act’s premium tax credits, rental assistance, and others. In contrast, UI provides weekly benefits. Tax credits like the EITC and CTC have traditionally been provided on an annual basis following the filing of tax returns each winter and early spring. However, the IRS is about to start issuing CTC benefits on a monthly basis, beginning in July 2021 and expiring in December 2021. In the case of tax credits, eligibility and benefit levels continue to be based on annual income. In programs like SNAP and Medicaid, eligibility is based on monthly income; using monthly income rather than annual income enables people who recently were laid off or who experienced another type of major income loss to qualify more expeditiously.

Eligibility

Eligibility varies widely for programs depending on a program’s goals, target population, and administration. The target population might be people with work records, current workers, children, families with children, people with disabilities, people who are age 65 and older, people with low incomes, pregnant or nursing women, or some combination of these groups.

Applicants to programs such as Social Security, Medicare, and UI need work records of varying lengths to qualify. These programs do not have an income eligibility limit and are often referred to as universal, though they do require a specified number of quarters or years of paid employment. A few programs require a beneficiary to have earned income; the EITC is a leading example. Other programs require incurring a particular type of expense, such as child-care costs.

Some social insurance programs require their beneficiaries to be part of a designated demographic group. To qualify for Social Security, individuals must be 62 or over, seriously disabled, a spouse or dependent child of a covered worker in some cases, or a surviving spouse or dependent child of a deceased individual who was a covered worker. To qualify for CHIP an individual must be a child under age 19. To qualify for the WIC nutrition program, an individual must be a pregnant, nursing, or postpartum woman or a child under age five. Many programs have eligibility requirements that will automatically qualify a person for other benefits. One example: someone who receives SSI is categorically eligible for SNAP and Medicaid in most states. Recipients of TANF benefits also become automatically eligible for SNAP.

Most social insurance programs have income limits. Several programs, such as Medicaid, have differing income limits for different demographic groups such as children or adults below age 65. Several decades ago, it was common to think of programs as being either universal (having no upper income limit) or targeted on the poor, but that categorization is no longer very useful. Increasingly, targeted social insurance programs cover both low-income households and households that are somewhat higher—often much higher—on the income scale. For example, the Affordable Care Act’s premium tax credits to subsidize the purchase of health insurance go up to 400 percent of the poverty line—$106,000 for a family of four in 2021 (and during the pandemic and economic downturn to levels higher than that). The CTC provides at least a partial credit to married filers with two children with incomes up to $480,000.

A declining number of programs also impose asset tests, the most restrictive of which are the asset tests in SSI and in Medicaid for people who are age 65 and older or who have a disability. This reflects the fact that some older people are retired and have low current income, but may have extensive savings. Most states also impose asset tests for the receipt of cash assistance under the TANF block grant. Medicaid does not impose an asset test for children or non-elderly adults, however (except those qualifying under Medicaid’s eligibility category for people with disabilities), and states have options to greatly ease or dispense with asset tests in SNAP, which most states have taken. Rental assistance programs also do not have asset tests.

Various programs also set other eligibility conditions or restrictions. UI requires beneficiaries to search for jobs. For TANF participants and some SNAP and housing assistance participants, time limits are imposed on participation unless they are meeting a work requirement. For SNAP, states can secure waivers from this time limit for areas with elevated unemployment and can provide individual exemptions. Several other programs allow states to restrict eligibility further, to exclude people such as ex-felons or people found to be using banned substances.

Eligibility among Immigrants

Most social insurance programs are available to US citizens and various categories of legally present immigrants, such as legal permanent residents, but not to people who are undocumented. The categories of legally present immigrants who qualify vary to some degree by program.

In programs that require extensive earnings records like Social Security and Medicare, legally-present immigrants who entered the United States late in life often do not qualify because they do not have a sufficient number of years of earnings in the United States. In addition, several major programs like Medicaid and SNAP impose a different type of restriction on legally-present immigrants—a bar on receiving these benefits during an immigrant’s first five years in the United States, with certain exceptions. In SNAP, children, refugees and asylees, and people receiving federal disability benefits are exempt from the five-year bar, but it applies to most other recently arrived legally present immigrants. In Medicaid and CHIP, refugees and asylees are exempt from the five-year bar, and states may elect whether to exempt children from the bar (35 states do) and whether to exempt pregnant women (25 states do).

Participation and Take Up

Take-up rates in social insurance vary by program. The term “take-up rates” refers to the share of eligible people or households that enroll and participate in the programs. For example, a study estimated that 77 percent of those eligible for UI from 1989 to 2012 collected it, though some states had estimated average take-up rates over this period below 50 percent (Auray, Fuller, and Lkhagvasuren 2019).

Take-up rates can vary not only across programs, but also across different parts of the same program. For example, the IRS estimates that 82 percent to 86 percent of families with children that are eligible for the EITC receive it. By contrast, the take-up rate for the EITC for childless workers was estimated to be only 65 percent in tax year 2016, which likely reflects the fact that the “childless EITC” provides small benefits that pale in comparison to the benefits that families with children receive (IRS 2020). Higher benefit levels in social insurance programs are, not surprisingly, associated with higher take-up rates. Similarly, take-up rates in SNAP are substantially higher for families with children than they are for older adults, who receive much smaller benefits on average. WIC’s estimated overall take-up rate was just over 50 percent in 2017 (US Department of Agriculture [USDA] 2020): eligible infants were far more likely (79 percent) to participate in WIC than eligible four-year-old children (25 percent).

The SNAP program provides a good illustration both of the fact that participation rates tend to be higher for households eligible for more-substantial benefits and of the fact that take-up rates can improve over time. USDA data show that, in 1980, some 52.5 percent of the households eligible for SNAP received it. In 2017, by contrast, 87.5 percent of eligible households received SNAP. The data also show that in 2012, the last year for which these particular data are available, 87 percent of the eligible households received SNAP but these households accounted for 96 percent of the total benefits that eligible households would have received if everyone eligible had participated (USDA 2019). That’s because participation rates tend to be higher among those who are eligible for larger SNAP benefits.

Policymakers, practitioners, and others who seek to boost program take-up rates are now increasingly relying on advances in information technology (IT) to boost take up—in particular, on using an individual’s or household’s participation in certain programs to enroll the individual or household automatically (or nearly automatically) in other programs for which they qualify. Practices are growing in Medicaid and SNAP, for example, to electronically screen people participating in one of these programs to facilitate their enrollment in the other program, as are efforts to use SNAP or Medicaid enrollment to enroll children automatically in free school meals. States are also increasingly relying on IT to reduce the number of times that households must go to social service offices in person to apply for, or renew their eligibility for, benefits; doing so tends to increase take up and retention (and to reduce churn, where households slip off the programs despite remaining eligible for them and must reapply to reenroll).

Enrollment

Enrollment in social insurance programs is a function of both eligibility and take-up rates. Program enrollment can change dramatically if the economy is in a recession. For example, the average number of individuals collecting regular UI in a given week in 2007 was 2.5 million, but in 2009, at the height of the Great Recession, the annual weekly continuing claims average was 5.8 million. In figure 2 the largest social insurance programs are sorted by the number of recipients in 2018, near the peak of the last economic cycle.

It is important to note that many of these programs are accessed by the same individuals or families; therefore program counts from the administrative websites should not be summed to estimate total participation across social insurance across programs. In 2018 Medicaid and CHIP had the highest recipiency, followed by Social Security (OASDI). UI recipiency was relatively low in 2018 (it was the lowest of the major programs that year), but it climbed dramatically in 2020 when unemployment surged and Congress broadened the UI eligibility criteria and increased UI benefits on a temporary basis.

Many social insurance programs are targeted by income. To qualify for most of those programs, individuals, households, or families need to have income below a specified level, often a multiple of a threshold known as the poverty line. The income limits for the programs vary, often being set somewhere between from 100 percent and 300 or 400 percent of the poverty line. The US Department of Health and Human Services (HHS) issues the poverty-line thresholds used in determining eligibility for these programs and updates the thresholds each year, adjusting for inflation. In some of these programs the federal government sets the income limit; in other programs the states do, often within federal guidelines. Other social insurance programs do not have an income limit; typically, those programs—which include Social Security, Medicare, and UI—require a past earnings record of a specified duration.

Poverty and Social Insurance

To determine the effects of social insurance programs on poverty, analysts generally use what is known as the Supplemental Poverty Measure (SPM), rather than the so-called official poverty measure (OPM)—both of which are calculated by the US Census Bureau (Census). While the OPM is used to determine program eligibility, only the SPM counts the benefits from programs like SNAP, rental vouchers, refundable tax credits, and the like as income in determining whether a household is above or below the poverty line.* In particular, in measuring changes over time in the antipoverty impact of social insurance programs, analysts primarily use what is known as the anchored SPM, a version of the SPM that adjusts the poverty-line thresholds annually only for inflation. The anchored SPM provides a sound measure by which to compare poverty over time.3

In figure 3, historical data from the SPM, using estimates provided by the Center on Poverty and Social Policy (CPSP) at Columbia University, show that expansions in various social insurance programs over the past half-century have markedly reduced poverty. The data show social insurance programs had only a small effect on poverty in the 1960s, when a number of these programs were in their infancy and were much smaller than they are today or did not yet exist. But by 2019, social insurance programs had reduced the poverty rate under the anchored SPM from 22 percent before income from the programs is counted to 11 percent when that income is taken into account. Moreover, these data (and other data in this paper on the antipoverty effects of social insurance programs) understate those effects because they are based on Census data in which the number of people receiving various benefits is undercounted (Meyer, Mok, and Sullivan 2009).4

Another way to track the increased anti-poverty effectiveness of social insurance is to examine what percentage of people who are poor before social insurance are lifted above the poverty line by it. The Center on Budget and Policy Priorities (using an SPM anchored to 2019 – that is, an SPM in which the poverty-line thresholds for years before 2019 are adjusted for inflation) has shown that in the late 1960s, government benefits and taxes lifted out of poverty approximately 5 percent of those who would otherwise be poor, while by 2019, benefits and taxes lifted out of poverty about 48 percent of those who would otherwise be poor.

Looking across the age distribution (figure 4), the impact of social insurance programs on poverty is especially noteworthy for children and older adults. Older adults have the largest reduction in poverty as a result of the social insurance system, because Social Security is such a large source of income for the elderly (Some 74 percent of Social Security benefits go to retirees and their dependents; SSA 2021). Before taxes and transfers, households whose oldest member is age 65 or more—who compose the bulk of Social Security recipients—have the highest poverty rates of any age group; after the effects of the Social Security system and various other programs are taken into account, the poverty rate for older adults is dramatically lower, although it still is somewhat higher under the SPM than the poverty rate for children and working-age groups. With respect to children, the SPM child poverty rate before benefits and taxes was 20 percent in 2019. After benefits and taxes are taken into account, the child poverty rate was 11 percent.

Figure 5 displays data produced for THP by Danilo Trisi and Matt Saenz of the CBPP, showing that the large reduction in child poverty that results from benefits and taxes stems in substantial part from the EITC, CTC, and SNAP. The EITC and CTC together reduced child poverty by nearly 7 percentage points in 2017. SNAP, considered by itself, reduced the overall child poverty rate by more than 4 percentage points. (In 2009, during the Great Recession, SNAP had an even larger effect on child poverty reduction at more than 5 percentage points. In addition, UI reduced child poverty by 2 percentage points that year.)

Nonetheless, for some groups of children, poverty rates after taxes and transfers remain very high. The National Academy of Sciences found that in 2015, child poverty rates for Black and Hispanic children were more than twice as high as non-Hispanic white children. The same report found that children of single parents endure double the poverty rate of a two-parent household (NAS, 2019).

Poverty and Race

Poverty rates have long been significantly higher for Black and Hispanic households than for non-Hispanic white households due to numerous factors, including discrimination and disparities in access to employment, education, and health care. Another CBPP analysis found that in 2017, government assistance programs cut the white poverty rate by more than half, the Black poverty rate by 44 percent, and the Hispanic poverty rate by 37 percent (CBPP 2013–17). In part, these findings reflect the fact that, on average, poor white families have incomes before government benefits that are closer to the poverty line than do poor Black and Hispanic families. As a result, a given amount of assistance will tend to lift a larger share of poor white people over the poverty threshold than of poor non-white people. Those figures also reflect the fact that a larger share of poor Hispanic people, in comparison to poor white or Black people, are ineligible for many social insurance programs due to factors related to immigration status. Nonetheless, over time the Black and Hispanic poverty rates have declined significantly, particularly after government assistance and taxes (Trisi and Saenz 2021).

An analysis of the anti-poverty impact of social insurance programs by race is incomplete, however, if it looks only at reductions in poverty rates—i.e., at the share of people who would otherwise be poor that the programs lift above the poverty threshold. It’s important also to look at the reduction by race in the poverty gap — the amount by which all poor families—or all poor families in a racial or ethnic group—fall below the poverty line.5 Analysis by CBPP of the effect of federal programs and taxes on the poverty gap by race finds that in 2017, programs and taxes reduced the poverty gap among white households by 73 percent, the Black poverty gap by 69 percent, the Hispanic poverty gap by 60 percent, and the Asian poverty gap by 46 percent.

Income Inequality and Social Insurance

Another important measure, in addition to measuring how the social insurance system affects poverty, is the system’s effect on inequality. The social insurance system in combination with the broader tax system – which includes various tax credits and other tax expenditures – significantly reduces income inequality. But inequality remains quite wide in the United States, and policymakers should consider ways to make the social insurance system more effective on this dimension.

A common way to gauge the reduction in inequality that results from a country’s policies is by looking at how the tax and transfer system of the country (i.e., the country’s social insurance and tax systems) affects what is known as the country’s Gini coefficient, which measures the degree of income inequality. A country in which everyone has the exact same income would have a Gini coefficient of 0. A country in which one person earned all the income and everyone else had no income would have a Gini coefficient of 1. Hence, a higher Gini coefficient reflects greater income inequality.

Figure 6a shows Gini coefficients across the advanced Organisation for Economic Co-operation and Development (OECD) countries both before taxes and transfers are taken into account and after taxes and transfers are considered. In this figure, countries are ranked by their Gini coefficients before tax and transfers are taken into account. The United States, shown in red, has among the highest levels of income inequality before taxes and transfers. Figure 6b then ranks the countries again based on their Gini coefficients, with the rankings in this figure reflecting where the countries stand after taxes and transfers are taken into account.

As the two figures show, tax and transfer systems reduce income inequality in all the other advanced OECD countries. The United States, however, not only is among the countries with the greatest inequality before taxes and transfers; it also has the widest inequality after these policies are taken into account. This is a result both of pretax and transfer income inequality being high in the United States relative to the other advanced OECD countries and of the reduction in inequality from taxes and transfers (shown by the length of the arrows in the figures) being smaller in the United States than in most other OECD countries.

This chapter describes the major social insurance programs within five broad categories:

The descriptions that follow give only a sense of the scope and structure of the major programs. They are not meant to be (nor could they possibly be) exhaustive. In addition, we touch on the efficacy of these programs and summarize Hamilton Project proposals to improve various aspects of the social insurance system.

Education and workforce development is a broad category. It includes a wide range of programs from those that support early childhood education, which can also function as child-care programs for children younger than three years old, to student loan programs for college and graduate students, to workforce development programs for workers in midcareer.

Early Childhood Care and Education (ECE)

ECE is a term used to describe center-based care and other nonparental forms of supervised child care. ECE can refer to preschool or pre-kindergarten programs that support children’s early social and academic development as well as day care. Programs that support access to child care for eligible families include Early Head Start, Head Start, the Child Care Development Fund (CCDF), and the Preschool Development Grant (PDG). As of 2019 there were 5.4 million children in a federal or state ECE program. In 2017, $34 billion was spent on ECE services by governments in the United States, with states and local governments spending $12 billion and the federal government spending $22 billion (Gould and Blair 2020). As seen in figure 7, of children aged three and four who participate in a preschool program, 63 percent participate in a public program, including Head Start. Nonetheless, there is not sufficient capacity for all eligible families to be served by the public programs. As a result, many lower-income families do not have the resources to enroll their children in a preschool program. (Workman and Jessen-Howard 2018; Malik 2019).

The benefits of ECE programs are well-documented. Evidence on the short- and long-term effects of ECE typically relates to the outcomes of specific programs, whether the evidence comes from the landmark evaluations of Perry Preschool, Abecedarian, and Head Start, or from the rollout of state preschool programs (see Cascio 2021 for a review). A meta-analysis of research on ECE concludes that children who participate in ECE programs in their first five years have lower rates of repeating a grade and higher high school graduation rates (McCoy et al. 2017).

Head Start and Early Head Start

Head Start and Early Head Start are the largest directly federally-funded ECE programs. Since these programs began, they have served more than 37 million children from birth to age five. Head Start and Early Head Start aim to reduce poverty by creating comprehensive preschool programs to meet children’s emotional, social, health, nutritional, and psychological needs. Income thresholds vary by location, but the majority of Head Start seats go to low income children.

In the 2018–19 school year, Head Start and Early Head Start accounted for nearly $10 billion in federal spending on ECE, funding about 927,000 seats. The average annual spending per child enrolled in the program is $11,000 (National Head Start Association 2020). Over the past decade, with an expansion of the Early Head Start program, enrollment of children under age three has increased, but in 2020, only 36 percent of eligible children aged three to five and 11 percent of eligible children under the age of three had access to Head Start or Early Head Start (National Head Start Association 2021).

Evidence shows that participation in the Head Start program has positive short- and long-term impacts. In the short-term, Head Start improves kindergarten readiness and academic outcomes through third grade (Feller et al. 2016; Kline and Walters 2016). Head Start is more effective in combination with more generous grade school spending (Johnson and Jackson 2019). Research also shows that Head Start improves outcomes including better health outcomes and additional education attainment (Deming 2009; Garces et al. 2002; Bauer and Schanzenbach 2016). In addition, Head Start increases positive parenting practices (Bauer and Schanzenbach 2016) and lessens the intergenerational transmission of poverty (Barr and Gibbs 2017). ECE and care also have positive employment effects for parents (Morrissey 2017; Davis et. al 2018).

Child and Dependent Care Tax Credit (CDCTC)

CDCTC subsidizes a portion of child-care costs, primarily for middle-income families. It has no upper-income limit, so high-income families qualify as well. Until the pandemic and recession, however, the credit offered little or no support for low- or modest-income families because the credit was not refundable—in other words, it was not available to those who did not earn enough to owe federal income tax. The ARP changes this feature temporarily; for 2021, the credit is both enlarged and made fully refundable, so low-income families who incur out-of-pocket child-care costs can qualify.

Early Childhood Education Block Grants

ECE block grants provide states with funds to provide high-quality child care (Vesley and Anderson 2009). For low- and modest-income families, funding from those grants is the principal source of child-care support. ECE block grants include the CCDF and PDG. States can use these funds to support child-centers and/or provide vouchers to lower-income families to help defray their child-care costs. These funds are not an entitlement and so the associated programs have limited funding; as a result, only about one in six eligible children benefit from those programs (National Women’s Law Center 2019).

Nonetheless, early evidence shows that the PDG supports either increased enrollment or enhancements in state preschool programs (Friedman-Krauss et al. 2020). A summary report on the PDG shows that enrollment in PDG-funded classrooms increased by 87 percent over the four years after the grant was administered. This means that twice as many families and children had access to high-quality care in the fourth year of the grant as in the first year (OESE 2019).6

Under the CCDF, states have broad flexibility to design programs within a set of federal guidelines. Research shows that differences in parental time-use and other eligibility requirements across states create burdens for both parents and administrators, limiting the ability for families to have steady child care (Adams et al. 2014; Adams and Heller 2015; Jenkins and Ngyuen 2019; Johnson-Staub, Matthews, and Adams 2015). In addition, Herbst and Tekin find evidence that subsidies are associated with negative child development outcomes because expanding access without ensuring quality increases exposure to lower-quality center-based care (Herbst and Tekin 2008).

Postsecondary Education

Since the introduction of federal student aid programs in the mid-1950s, the federal government has subsidized the cost of postsecondary education, lowering barriers for students with financial need. The annual Free Application for Federal Student Aid (FAFSA) form acts as a yearly application for the primary federal need-based aid programs: Federal Pell Grants, Direct Subsidized Loan Program, Federal Supplemental Educational Opportunity Grants (FSEOG), and Federal Work-Study (FWS). The FAFSA feeds into a formula that calculates eligibility using the difference between the cost of attendance and an estimated expected family contribution.

In the 2019–20 academic year, undergraduate and graduate students received an estimated $143 billion in combined financial support in the form of grants, student loans, and tax benefits from federal programs (College Board 2020). While federal support generally targets students, state and local governments support the operations of in-state schools. Nearly 80 percent of the $103 billion in combined higher education funding from state and local governments went to such operations while 11 percent was targeted to financial aid grants for students (Laderman and Weeden 2020).

Those with postsecondary credentials have better labor market outcomes than those who do not, but these are not the only benefits that these degrees confer. In general, much of the evidence for the value of a postsecondary education indicates that degree holders both earn more and have better nonpecuniary outcomes, including higher rates of community engagement and overall healthier lives (Oreopoulos and Petronijevic 2013; US Department of Education [ED] 2016). In addition, those with a postsecondary degree are better able to weather economic downturns. For example, they enjoyed significant better labor market outcomes after the Great Recession (Carnevale, Jayasundera, and Gulish 2016; Greenstone and Looney 2011).

Pell Grants and On-Campus Programs

The Federal Pell Grant Program is the largest single postsecondary grant program, awarding nearly $28 billion in grant aid to 6.7 million low-income college students in the 2019-20 academic year (College Board 2020). The maximum Pell Grant award, which was $6,495 for the most recent award year (Federal Student Aid 2021) , has not kept up with the sticker price of a four-year degree; grant aid has been falling as a share of cost of attendance for decades (figure 8). In 2017 the maximum Pell Grant covered just 29 percent of the average costs of tuition, fees, room, and board at a public four-year college, compared with 79 percent in 1975 (Protopsaltis and Parrott, 2017). The remaining annual cost increasingly falls to students and their families, where a large majority turn to student loans for help.

Three additional programs under the Higher Education Act (HEA), known as on-campus programs, are unique among needs-based student aid programs in that schools’ financial aid offices determine the mix and amount of aid awarded and are required to formulaically match federal funds. These programs include the FSEOG program, which allows schools to award additional grants and loans to students with exceptional financial need, as well as the FWS program, which provides part-time work opportunities either with the school or with participating organizations and businesses.

Evidence shows that recipients of Pell Grants generally have higher transfer rates to four-year institutions and lower drop-out rates than those who do not receive the grant (Mundel and Rice 2008). Extended benefits of Pell Grants, aside from reduced tuition cost, are mixed. Marx and Turner find that students who miss the cut-off for Pell awards end up receiving more on average from other aid sources (Marx and Turner 2015; Scott-Clayton and Park 2015). There is little definitive evidence showing that Pell recipients have higher enrollment, completion, or persistence rates among traditional low-income students (Baum and Scott-Clayton 2013; Bettinger 2004; Turner 2014). Research regarding the impacts of on-campus programs is scant. Current evidence is limited to single-institution or state data, and the findings are inconsistent (Scott-Clayton 2011; Scott-Clayton and Minaya 2014; Stinebrickner and Stinebrickner 2003).

Student Loans

Needs-based Direct Subsidized Loans are available only to undergraduate students and provide the most favorable borrowing terms, including interest rates much lower than market rates. In addition, no interest is assessed while the student is enrolled in school, during a six-month grace period following either graduation or a change from full-time enrollment status, and during periods of authorized deferment. Nonsubsidized loans have the same below-market interest rates as subsidized loans, but interest is assessed immediately. Together, Direct Subsidized and Direct Unsubsidized Loans from the federal government provided 86 percent of the $102 billion in student loans issued for the 2019–20 academic year, including 80 percent of loans to undergraduates and 96 percent of the higher-interest, higher-balance loans to graduate students (College Board 2020). When federal loan payments come due, students may select from a myriad of repayment plans, including income-driven repayment (IDR). IDR plans are designed to make loan repayment more manageable by adjusting required monthly payments according to a borrower’s income, and by offering loan forgiveness on the remaining balance after a period of 20 or 25 years under certain terms.

Most Americans will take out a student loan to cover the cost of their postsecondary education, but the aid from loans can do more than cover educational costs. Yilla and Wessel (2019) find that many students also use the loans to support their cost of living in addition to tuition and fees. Growing evidence shows that a majority of students complete a bachelors degree with less than $40,000 in debt (Council of Economic Advisers [CEA] 2016; Looney, Wessel, and Yilla 2020). Despite their borrowing relatively low amounts, research consistently shows that students of color are more likely to default on payments than are their white counterparts (Harrast 2004; Scott-Clayton 2018; Volkwein and Cabrera 1998; Volkwein and Szelest 1995; Woo 2002). Defaulting on student loans leads to a host of problems: loss of access to repayment tools, damaged credit, increased collection fees, garnished wages, and even ineligibility for other aid programs (PEW 2020).

Tax Incentives

The federal government also lowers the cost of higher education through 12 different tax benefits, including the exclusion of scholarships from taxable income and the deductibility of student loan interest. In all, these tax incentives cost $27 billion annually in forgone revenue at the federal level. The two largest tax credit programs, the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), which extend credits to low- to moderate-income families for qualifying education expenses of up to $2,500 and $2,000 respectively, combined for 67 percent of total education-tax benefit costs in 2019 (Congressional Research Service [CRS] 2021).

Evidence suggests that the AOTC and LLC have little impact on enrollment nor do they affect college choice, student debt, or tuition paid (Hoxby and Bulman 2015, 2016). Studies show that the complexities of claiming the credits and their delayed delivery blur any significant impact (Dynarski and Scott-Clayton 2018; GAO 2012).

Workforce Development

The US workforce development system functions in a complementary manner to the US higher education system, supporting the training and retraining of experienced workers, jobseekers, and new entrants who typically lack a four-year postsecondary credential. In the broadest sense, workforce development encompasses a variety of programs and institutions aimed at providing job-related skills to workers, including certificate programs at community colleges, vocational courses offered by training providers, and apprenticeship programs, as well as career services like job search assistance and career counseling.

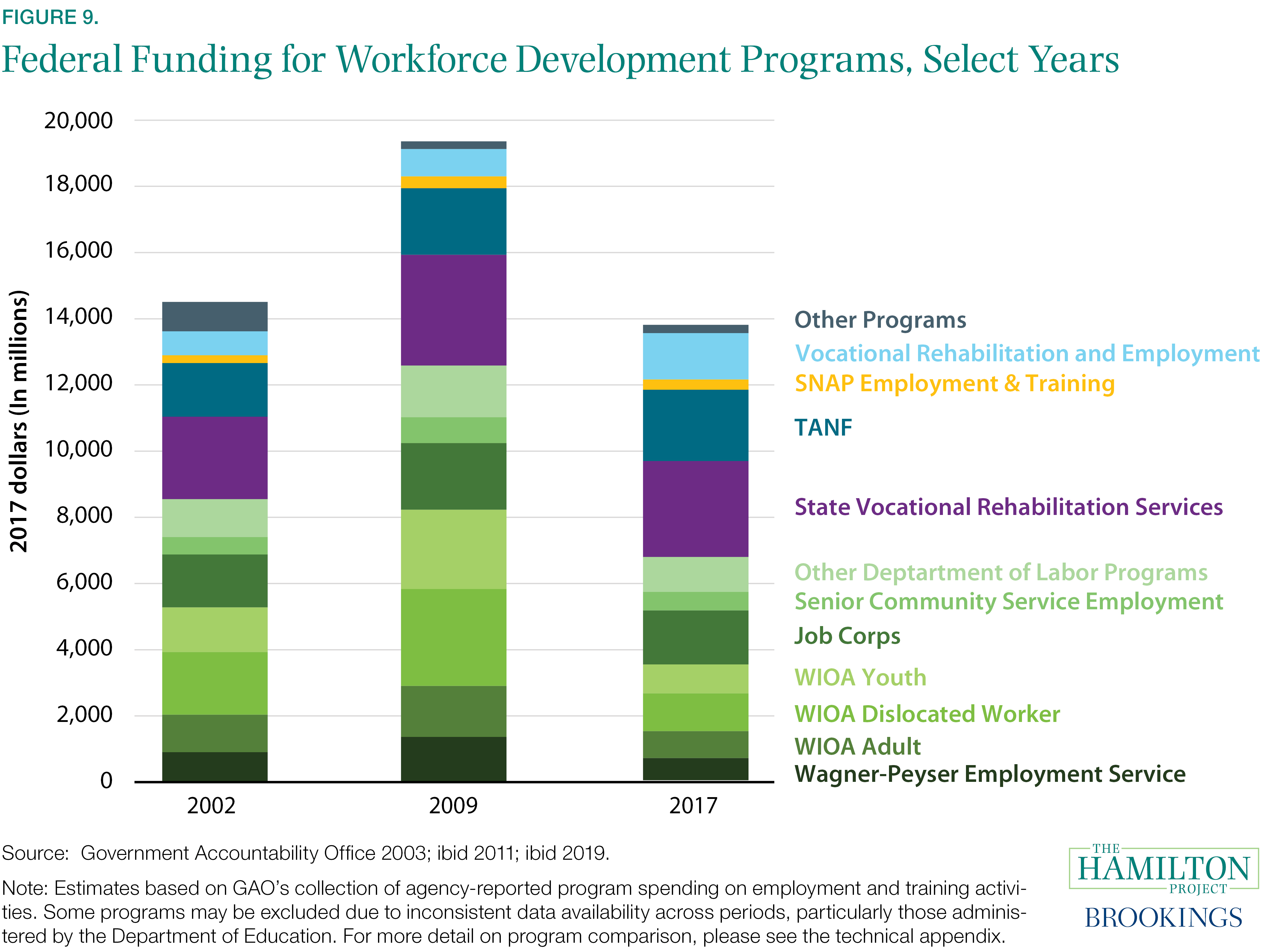

Given underinvestment in training by employers and private entities, the federal government invests in training programs and reemployment services for displaced and disadvantaged workers. The signature workforce legislation at the federal level, the Workforce Innovation and Opportunity Act (WIOA), was signed by President Barack Obama in 2014, reauthorizing the expired Workforce Investment Act (WIA). The collection of WIOA programs is structured to offer adults over age 18 broad access to its range of services, , while also providing priority services to low-income and skills-deficient job-seekers. Several other programs target specific populations including disadvantaged youth, transitioning veterans, and other groups. Together, federal support for employment and training stretches across 43 workforce programs, spanning nine federal agencies, to target various populations of American workers (GAO 2019). Figures 9 and 10 show the training programs and reemployment services funded by WIOA. Aside from employment services, most programs have drastically low take-up. The system is characterized by a lack of coordination and chronic underfunding.

Evidence for the effect of workforce development programs in recent decades is mixed (Bauer, Breitwieser, and Shambaugh 2018; Greenberg, Michalopolous, and Robins 2003). Workforce development programs that focus on particular populations and sectoral programs have been found to be more effective at improving labor market outcomes, including raising wages (Elliot and Roder 2017; Hendra et al. 2016).

THP Proposals: Education and Workforce Development

One THP proposal would significantly increase access to affordable, high-quality ECE by expanding existing Head Start and Early Head Start programs and creating a new program that would stimulate competition among eligible child-care providers and raise compensation for ECE workers. All families would have multiple child-care provider options, and a cap would be placed on the total family payment for child care so that no family goes deeper into poverty to pay for care for their young children. (To learn more, read the THP proposal by Elizabeth Davis and Aaron Sojourner [2021].)

Putting in place job subsidies would help to create jobs in disadvantaged areas. A THP proposal by David Neumark (2018) would create a program of community job subsidies, providing federal funding to partnerships of local employers, nonprofits, and community groups that would identify local needs and administer jobs. These jobs would be restricted to workers with income below 150 percent of the poverty line and be 100 percent federally subsidized for the first 18 months; these workers’ employers would be eligible for a 50 percent subsidy in the second 18-month period. These job subsidies would be targeted to economically disadvantaged areas in which 40 percent or more of individuals are below the poverty line.

Creating a well-prepared workforce will require centers of learning to be responsive to changing business conditions and better able to adapt to new technologies. Another THP proposal calls for providing federal support for online educational credits that would be issued to qualified adults at accredited and registered learning organizations. Program providers would be expected to solicit input from employer groups, professional associations, and unions regarding program offerings. Providers would also be prohibited from charging tuition and fees in excess of reimbursement, thereby encouraging programs to innovate toward lower-cost delivery by making the best use of technology. In addition, a national initiative would be established between federal agencies and a network of competitively selected universities and their partners to accumulate knowledge and inform policy on adult learning. (To learn more, read the THP proposal by Richard Arum and Mitchell Stevens [2020].)

To build a stronger, more-coherent workforce training system, reforms could increase funding for the HEA to enable postsecondary institutions to expand occupational training. To achieve this, another THP proposal would place a modest tax on employers who displace workers through automation, adding incentive for firms to retrain workers rather than displace them. In addition, a permanent version of the Trade Adjustment Assistance Community College and Career Training (TAACCCT) grant program could be introduced to fund partnerships between and among community colleges, workforce training institutions, and states, in order to ensure coordination to improve outcomes for students and displaced workers. (To learn more, read the THP proposal by Harry Holzer [2021].)

Prior THP proposals on human capital development from ECE through workforce development are summarized in Bauer, Breitwieser, and Shambaugh 2018.

The United States primarily relies on a mixed health-care delivery system where most people are covered by either public insurance or employer-sponsored insurance, but millions are left out and are uninsured. On the employer-based insurance side, the federal government spent $291 billion in fiscal year 2020 by excluding from taxable income premiums on employment-based health care coverage. Because the value of that tax exclusion increases at higher marginal tax rates and as premiums rise, larger subsidies go to people with higher incomes (CBO 2020a).

The federal government operates four main health insurance programs—Medicare, Medicaid, CHIP, and premium tax credits (which lower the cost of insurance purchased through the Affordable Care Act’s health-insurance marketplaces). In addition, the federal government provides health insurance and health-care access for active-duty military personnel as well as for veterans through the VA system.

Figure 11 shows the yearly expenditures of the four main insurance programs as a percent of GDP. Since shortly after their creation in the 1960s, Medicare and Medicaid spending as a percent of GDP has been higher than spending on other health programs. Spending on Medicare and Medicaid expanded from less than half a percent of GDP in 1966 to 3 percent and 2 percent of GDP respectively in 2018. Other federally funded health insurance programs have not experienced comparable growth. As seen in the figure, active-duty military and veteran health insurance hovered around 0.2 percent for nearly four decades before rising to 0.4 percent. The Affordable Care Act and CHIP accounted for a combined 0.3 percent of GDP spending in 2018.

Job-dependent health coverage can create instability, as highlighted by the crisis created by the COVID-19 pandemic (Collins et al. 2020). Between 2019 and 2021, more than 1.2 million more individuals have obtained health insurance during the special and open enrollment periods through the marketplaces created by the Affordable Care Act. Between March and August, 2020, 5 million other people newly enrolled in Medicaid and CHIP, many after losing their jobs and employer-sponsored health insurance. Prior to the pandemic, a substantial majority of the states had adopted the Affordable Care Act’s Medicaid expansion, making poor adults younger than age 65 whose current incomes are below 138 percent of the poverty line eligible for Medicaid, which almost certainly helped significant numbers of residents of those states remain insured during the crisis.

Figure 12 shows Medicaid and CHIP enrollment growth between February and August 2020. Interestingly, of the 13 states that have not implemented the ACA’s Medicaid expansion, four (Florida, Missouri , Utah, and Wyoming) saw increases in Medicaid and CHIP enrollment of over 10 percent in the 6 months following the onset of the pandemic.7

Of the 29.8 million individuals without insurance in 2019, two-thirds were eligible for subsidized health insurance: roughly 20 percent met requirements for Medicaid and CHIP, and roughly 50 percent were eligible for a marketplace subsidy or subsidized employer-sponsored health coverage. Employer-sponsored health coverage is subsidized for many individuals through employer contributions, as well as through arrangements that exclude from taxable income employee premium payments deducted from paychecks. Of the one-third of the uninsured in 2019 who were not eligible for subsidized health coverage of some sort, 5.9 million were ineligible either because their incomes were too high for marketplace subsidies or because their incomes were too low for those subsidies but they were ineligible for Medicaid because they lived in a state that has not adopted the Affordable Care Act’s Medicaid expansion (CBO 2020b).

Medicaid and the Children’s Health Insurance Program (CHIP)

Medicaid is the largest of the means-tested in-kind social insurance programs, offering comprehensive health coverage to beneficiaries, generally with no premiums (at least for people below the poverty line) and with low copayments and cost-sharing. As a federal-state partnership, Medicaid provides health services and covers health-care costs to improve health among eligible low-income families with children, pregnant women, and people who are 65 or over or have disabilities, including Medicare beneficiaries with low incomes. Through the Federal Matching Assistance Percentage (FMAP), the federal government picks up 50 to 83 percent of a state’s Medicaid costs. At times during economic downturns, Congress has temporarily increased the percentage of Medicaid costs the federal government covers in order to deliver fiscal support to states as their Medicaid caseloads rise. States may also opt to expand coverage to low-income adults younger than age 65 with incomes up to 138 percent of poverty, and all but 13 states have implemented this expansion, with the federal government paying 90 percent of the cost on an ongoing basis. In 2020, the Urban Institute found that the lack of implementation in the 14 states that had not yet implemented it (including Oklahoma, which is implementing the expansion on July 1, 2020) resulted in an estimated 4.4 million more low-income individuals being uninsured.

In 2020 about 68 million individuals were covered by Medicaid in an average month. Most of the increase in Medicaid take-up resulting from expansions in coverage by states came from the uninsured population rather than from people substituting Medicaid for private insurance (Finkelstein et al. 2012 ). Conversely, past roll-backs to Medicaid eligibility in some states have resulted in increases in the ranks of the uninsured without significant increases in private health insurance enrollment, regardless of employment (Garthwaite, Gross, and Notowidigdo 2014).

Medicaid saves lives (Goodman-Bacon 2018; Miller, Johnson, and Wherry forthcoming) and improves the quality of life (Miller and Wherry 2019). Medicaid also increases annual health-care use among children and adults (Currie, Decker, and Lin 2008; Currie and Gruber 1996; Card and Shore-Sheppard 2002), as well as hospitalizations (Dafny and Gruber 2005), while reducing avoidable hospitalizations (Aizer 2006 ). Studies of the Oregon Health Insurance Experiment found greater use of health care as a result of Medicaid coverage, as well as a higher likelihood of filling a prescription and better self-reported health (Baicker et al. 2013; Finkelstein et al. 2012; Taubman et al. 2014). Medicaid also insures families against certain health-related economic outcomes by reducing medical debt (Boudreaux, Golberstein, and McAlpine 2016; Finkelstein et al. 2012) and decreasing the likelihood of declaring bankruptcy (Gross and Notowidigdo 2011).

For families with modest incomes and with children who do not have private health insurance and do not qualify for Medicaid, there is CHIP. CHIP, which is administered by the states and funded jointly by the federal and state governments, provides health coverage for children in families who cannot afford private insurance but whose incomes exceed the Medicaid income eligibility limits. States can operate CHIP as a separate program or as a component of Medicaid.

CHIP has significantly increased health insurance coverage for children (Gruber and Simon 2008), including among the children of immigrants (Bronchetti 2014). States have some flexibility to set the terms of the program, such as charging premiums, which can result in lower take-up and a shorter duration of enrollment (Dague 2014). CHIP improves children’s health (Bronchetti 2014) and educational outcomes such as test scores (Levine and Schanzenbach 2009), as well as high school and college completion (Cohodes et al. 2016). In adulthood, enrollment is associated with better labor market outcomes, including higher labor force participation rates and earnings (Brown, Kowalski, and Lurie 2015).

Medicare

Medicare serves people who have a sufficient earnings record to qualify and are at least age 65 or who have serious disabilities. Individuals generally qualify either at age 65 or two years after the month for which they first receive federal disability benefits, although there are some exceptions to this rule. Medicare has several components. Medicare Part A provides insurance for inpatient hospital costs and does not charge a premium. Medicare Part B covers physician, laboratory, and outpatient hospital costs and charges a basic monthly premium that is subsidized for low-income enrollees who apply for that assistance; the premium is raised substantially for higher-income enrollees. Medicare Part D, which also charges a premium, provides prescription drug coverage. With respect to Part B, the majority of beneficiaries are enrolled in traditional, fee-for-service Medicare, in which the federal government operates the insurance program. But nearly 40 percent of enrollees now enroll in private Medicare Advantage plans, which operate under federal standards and generally offer combined Part B and Part D coverage.

Medicare increases health-care use and reduces mortality (Card, Dobkin, and Maestas 2009) including from cancer (Myerson et al. 2020). Like Medicaid, Medicare reduces out-of-pocket spending on health care (Finkelstein and McKnight 2008) and insures against health-related financial risks including medical debt (Barcellos and Jacobson 2015; Caswell and Goddeeris 2020; Goldsmith-Pinkham, Pinkovskiy, and Wallace 2020). Medicare Part D (prescription drug coverage) reduces the price that participants pay for prescriptions and increases use (Duggan and Scott Morton 2010, 2011). Medicare Part D reduces mortality (Dunn and Shapiro 2019; Huh and Reif 2017) and improves mental health (Ayyagari and Shane 2015). The growth of Medicare accounts for a substantial portion of the increase in federal spending on health care since the program’s introduction (Finkelstein 2007).

Military

The VA provides public health insurance for those who have served in the active-duty military, their immediate families, and their survivors. In 2019 more than 9 million enrollees received health insurance through this system. VA health benefits are available to qualified veterans regardless of whether they have other health-care insurance. For example, the benefits can supplement Medicare for people age 65 and over. Veterans pay no premiums for this health care, although they pay copayments in certain circumstances. Researchers have generally found that the VA health-care system provides higher-quality care than the private sector.

Premium Subsidies

Despite the different programs aimed at increasing the availability of health coverage in the United States, millions of Americans are still uninsured. For those who are not eligible for public health insurance and who do not have access to affordable employer-based coverage, the Affordable Care Act established premium tax credits that people with incomes between 100 percent and 400 percent of the poverty line can use to subsidize the purchase of health insurance in the Affordable Care Act’s marketplaces, along with a series or rules to ensure the marketplaces function effectively. A second set of subsidies, to reduce cost-sharing charges, is available to people enrolled in marketplace plans who have incomes between 100 and 250 percent of the poverty line. The tax credits generally are not paid directly to beneficiaries; rather, the US Department of the Treasury sends them directly to the insurance company in whose plan a beneficiary is enrolled. The ARP both increases the size of the subsidies and eliminates the 400 percent of poverty eligibility cut-off for 2021 and 2022. Debate is underway over whether to make those changes permanent. A report from the CBO suggests the high cost of health insurance premiums and deductibles and the complexities for enrolling for coverage create obstacles for some of the eligible to receive coverage. (CBO 2020b).

Family and Medical Leave

The Family and Medical Leave Act of 1993 (FMLA) allows eligible employees to take up to 12 work weeks of unpaid leave during any 12-month period for caregiving or illness recovery purposes. Employers and employees must meet several criteria for employees to use the FMLA for leave. The firm must be relatively large (at least 50 employees within a 50-mile radius, though in eight jurisdictions the threshold is lower); the employee must have worked for the employer for at least 12 months; and the employee must have worked at least 1,250 hours in the past 12 months. Additionally, the FMLA applies only to immediate family members in all but 11 jurisdictions.

The United States does not have a national paid leave program. Some states and localities have passed laws requiring employers to give eligible employees paid leave. As of early 2021, however, paid family leave—leave that can be used for post-birth/adoption care and caregiving for sick family members—is available in only six states. Two others have passed legislation and are in the process of implementing it. Funding mechanisms differ by state and are typically financed by a small payroll tax on wages; wage replacement rates and weeks available of paid leave vary by state. In the absence of state or local laws, paid leave is up to the employer.

FMLA reduces worker turnover (Appelbaum and Milkman 2011) and enhances children’s health (Rossin 2011; Ruhm 2000). Economic benefits of FMLA for workers and employers include increased labor-force participation, increased lifetime earnings and retirement benefits, and increased use of leave (Boushey, O’Leary, and Mitukiewicz 2013). Research from states with paid leave programs find higher rates of maternal leave take-up and increased job return post-leave (Baum and Ruhun 2013; Byker 2016; Rossin-Slater, Ruhm, and Waldfogel 2011). The positive effects of leave are strongest among disadvantaged mothers (Byker 2016; Rossin-Slater 2013). However, some evidence shows negative wage effects from paid parental leave for women so the potential for paid leave policies to close the gender pay gap remain unclear (Bailey et al. 2019).

THP Proposals: Health