If there was a marketing effectiveness 'crisis', it's now over – Marketing Week

Our website uses cookies to improve your user experience. If you continue browsing, we assume that you consent to our use of cookies. More information can be found in our Cookies Policy and Privacy

Policy.

The industry has been telling marketers their ability to sell stuff using ads is in decline, but as well as not being particularly helpful it’s simply not true. New data shows ROI has been increasing over the past five years.

In Doctor Who, House or 24, each episode is a story, but the characters are also part of a bigger plot. Things that happen each week play into overarching ups and downs: questions, conclusions and journeys.

Marketing effectiveness is like that too. Each marketing team, each creative vehicle, each media plan has a story, but there is also a wider tale. It’s about whether we are generally making better choices than we used to. And about whether new things we have collectively tried have helped or not.

The big story that our industry has been telling itself in recent years is that there’s a crisis in effectiveness, that our ability to sell stuff using ads is in decline.

It really isn’t a great message PR-wise. It’s useful if there’s a problem and we need to course-correct. But if not, it’s a message that undermines marketers’ ability to do their jobs. It’s already easy for CFOs to question whether marketing is worth it and divert budget to other things. The simple message that marketing works bears repeating. We complicate the take-out at our peril.

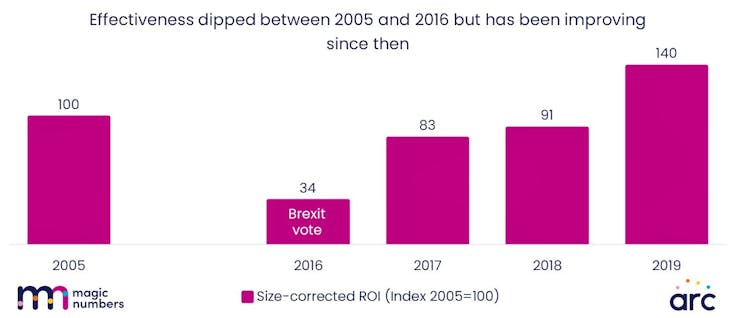

And there’s now new data that adds a chapter to what we know. It suggests that if there ever was a general crisis of effectiveness, it’s over now. Return on investment has been increasing in the last five years, and it’s now at comparable levels to 2005.

Evidence on these issues is never going to be perfect, but in 2021 there was a big step forward. A group of analytics companies – D2D, IRI, OMG, VCCP media, and magic numbers – agreed to share anonymised data on UK advertising they’ve evaluated using econometrics.

This built into a database that was quite a lot bigger than others like it that had come before. And for once, it didn’t just have award winners in it. It was named ARC for the advertising research community that came together to build it.

The data suggests that currently there is no crisis. The average return on investment in recent years – among ordinary, unawarded campaigns – is £3.80 in revenue per £1 spent on advertising. And effectiveness is not in decline. The chart above shows the data. It’s a simple graph, but each bar contains the results of between 44 and 139 econometrics studies, each including three years of advertising experience, properly evaluated. And the ROIs have been adjusted to take account of the size of the advertisers included, to ensure the makeup of the sample isn’t driving the results.

The chart above shows the data. It’s a simple graph, but each bar contains the results of between 44 and 139 econometrics studies, each including three years of advertising experience, properly evaluated. And the ROIs have been adjusted to take account of the size of the advertisers included, to ensure the makeup of the sample isn’t driving the results.

What it shows is that ROI declined between 2005 and the more recent data, and it was particularly low in the year of the Brexit vote. But since then, the return from UK advertising has been on the up, and by 2019 back to at least where it was in 2005.

Marketers are in pole position to shape consumer demand for sustainability

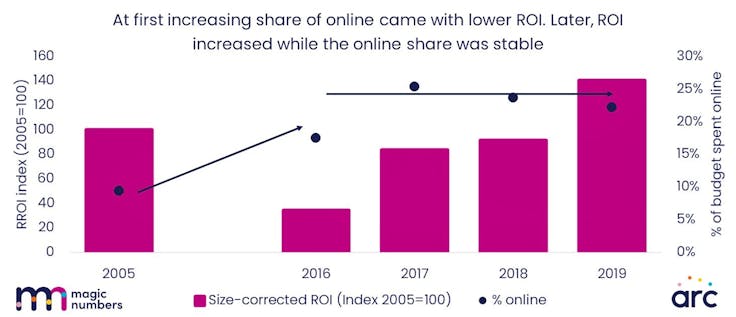

The data also has some clues on why returns to advertising have been changing. It suggests that effectiveness has been in flux as marketers, agencies and platforms, along with their research providers, experimented with new online media channels.

What happened was that a growing number of increasingly sophisticated online options and formats were made available to advertisers. Over time, we’ve learnt. So that now we know a lot more about which to use when, and how to make the best of each of them.

It’s likely this evolution towards a more mature use of online media explains the chart below. In the long period between 2005 and 2016, marketers didn’t always know how to use online well. So, when the share of budget for online went up, effectiveness went down. But after 2016, people were using the new tools more successfully, and continuing to learn, ROI had recovered and was continuing to increase. Experimentation with online is visible in the choice of media channels in the new data, plotted in the two charts below. Within offline, budget allocations have been stable, with about two-thirds of the budget going to TV and the remainder split between other offline channels in all years.

Experimentation with online is visible in the choice of media channels in the new data, plotted in the two charts below. Within offline, budget allocations have been stable, with about two-thirds of the budget going to TV and the remainder split between other offline channels in all years.

But within online, advertisers have been trying things, learning and settling at a better mix. The biggest change has been the declining share allocated to display. But in the period ROI was increasing there’s also been experimentation with paid search, which increased rapidly before falling back a little. And by 2019, the highest-ROI year, paid social had also expanded to sit alongside search as the most prominent online channel. Marketers who have lived through the years in these charts remember these changes and more. We used to decide which site our banner ad would be on, now we choose which audience should see it. We used to simply exist on Google, now we optimise for the best keywords. We used to target organic followers, now we know that’s often preaching to the choir. We didn’t used to know about bots, now we do. The list could go on.

Marketers who have lived through the years in these charts remember these changes and more. We used to decide which site our banner ad would be on, now we choose which audience should see it. We used to simply exist on Google, now we optimise for the best keywords. We used to target organic followers, now we know that’s often preaching to the choir. We didn’t used to know about bots, now we do. The list could go on.

The wrong and the real of marketing effectiveness

So just like the best characters in a long-lasting series, more online advertising isn’t ‘good’ or ‘bad’.

It’s flawed, and we haven’t always had a good experience with it. But it’s come a long way in the years we’ve known it, and it’s in a better place now.

And it’s likely to continue to be the protagonist. The changing backdrop for advertising effectiveness continues to move in favour of online. The pandemic made a lot of people who weren’t comfortable with making decisions online change their mind. And, slowly but surely, reach for offline channels is being eroded. But there’s no final answer on how to best use online yet. The chart on media mix above is far from settled and marketers and their research partners continue to experiment. That means there’s room for more learning by doing of the type that’s contributed to increasing effectiveness in the past five years.

But there’s no final answer on how to best use online yet. The chart on media mix above is far from settled and marketers and their research partners continue to experiment. That means there’s room for more learning by doing of the type that’s contributed to increasing effectiveness in the past five years.

So, it’s time to move away from the crisis narrative. The story is now in a much more optimistic phase.

With investment on a downwards trend, many brands are dealing with falling market research budgets. But marketing bosses at PepsiCo, Aviva and PZ Cussons believe expensive isn’t always better when it comes to producing quality insight.

Morrisons’ Christmas ad is the third most creatively effective this year, according to System 1’s analysis, with a star rating of 4.7 out of 5.9. The supermarket’s marketing director says the brand is increasingly focused on delivering effectiveness with its advertising.

As Marketer of the Year, Camelot CMO Keith Moor believes being an effective marketing leader comes down to building credibility by delivering on promises and having a curious mind.

There is one comment at the moment, we would love to hear your opinion too.

A great article! Where can we learn more about the details? I’d like to convince sceptics, especially accountants.

You must be logged in to post a comment.

Ellie Norman has stepped down from the role ahead of taking on a new challenge.

Boots’ CMO Pete Markey believes marketers must create a narrative around marketing to help demystify it to other functions, which helps finance “want to get it”, says CFO Michael Snape.

Iceland has promoted former head of customer and marketing, Caspar Nelson, to the resurrected marketing director position.

Hotel Chocolat has grown revenues by 40% in the first half of its financial year, with its digital strategy, subscription offer and loyalty scheme driving customer acquisition in all markets.

Xeim Limited, Registered in England and Wales with number 05243851

Registered office at Floor M, 10 York Road, London, SE1 7ND